USDT-margined Swaps is a kind of digital asset derivatives. Users can make profits from the rising/falling price of digital assets by going long or selling short positions based on their own judgment. Similar to a margin spot market, its price denominated in USDT is close to the index price of the underlying asset. The main mechanism for anchoring the spot price is the “Funding Mechanism”. There is no delivery for USDT-margined swaps, therefore, users can hold a position as long as they want. The USDT-margined swaps are settled every 8 hours and the current-period funding and unrealized PnL will be merged into the realized PnL after the settlement and be transferred to the user's account balance.

Mechanism

Margin ratio and liquidation: When the margin ratio is equal to or less than 0, liquidation will be triggered.

Isolated Margin Ratio = (Account Equity / Occupied Margin) * 100% – Adjustment Factor.

Cross Margin Ratio = Account equity / ∑all swaps under the cross margin account(Occupied margin * Adjustment factor)– 100%

- Funding: funding is a fee paid between the buyer and seller every 8 hours at the settlement. If the funding fee rate is positive, the longs have to pay funding to the shorts. If the funding fee rate is negative, the shorts have to pay funding to the longs. (Only users with net position greater than 0 at the settlement have to pay or receive funding.)

- Settlement time (GMT+8): 00:00, 8:00, 16:00

Isolated and Cross Margin Mode

Isolated margin mode: A kind of cross margin mode under which the margin for each swaps is calculated separately, that is, all the assets in the isolated margin account will be used as the margin for the position of the same swaps; The account equity and PnL for each swaps are calculated separately, and the position margin and PnL of each swaps will not affect each other.

Assume user A holds an isolated position of BTC/USDT swaps and an isolated position of ETH/USDT swaps at the same time. If the margin ratio of the isolated position of BTC/USDT swaps is ≤0% and triggers a liquidation, there will be no assets in this isolated account any more. At this time, the isolated position of ETH/USDT swaps could be held continually without being affected by the liquidation of BTC/USDT swaps.

Cross margin mode: All swaps under the cross margin mode share the same account equity, and some data such as their PnL, the occupied margin and the margin ratio are calculated jointly.

Assume user B holds positions of BTC/USDT and ETH/USDT swaps in cross margin account. Then the USDT assets in the cross margin account will be the margin for both BTC/USDT and ETH/USDT swaps. The margin ratios of these two swaps in the cross margin account are calculated jointly. Therefore, when the margin ratio of USDT cross margin account is ≤0 %, the positions of BTC/USDT and ETH/USDT swaps in cross margin account will trigger a liquidation at the same time.

The differences between USDT-margined Swaps and Coin-margined Swaps

- Quotation unit: USDT-margined Swaps is quoted in USDT while coin-margined Swaps is quoted in USD, therefore, their index prices are different. For example, the index price of BTC/USDT swaps is composed of the BTC/USDT spot prices from different exchanges while the index price of BTC/USD swaps is originated from the BTC/USD spot prices of different exchanges.

- Contract face value: the contract face value of USDT-margined swaps correspond to its underlying asset. For example, the face value of each BTC/USDT swaps contract is 0.01 BTC. For coin-margined swaps, the value of each contract is in USD. For example, the face value of each BTC/USD swaps contract is 100 USD.

- Margin currency: USDT-margined swaps of all tokens use USDT as margin. Users could trade various swaps only with USDT. Coin-margined swaps use the underlying asset of each swap as margin, therefore, users have to hold the corresponding token to trade. For example, users have to transfer BTC as margin first to trade BTC/USD swaps.

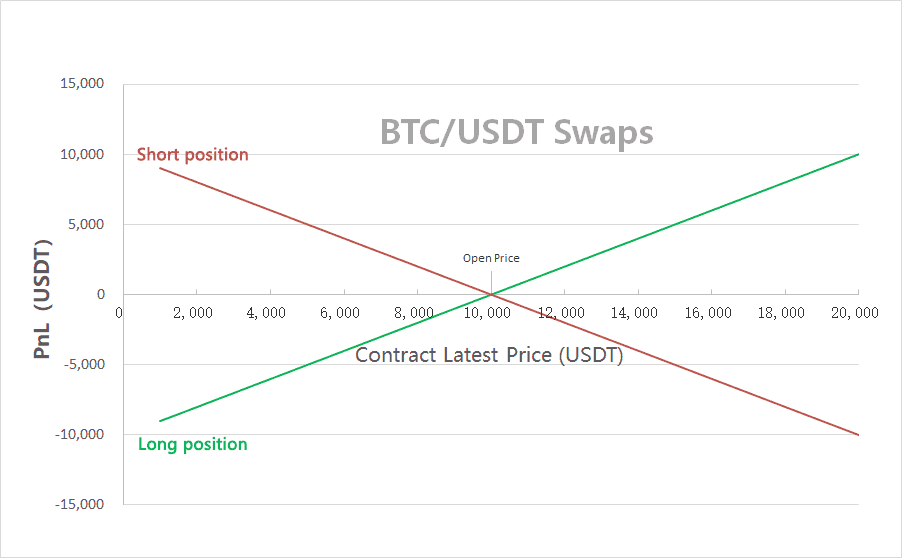

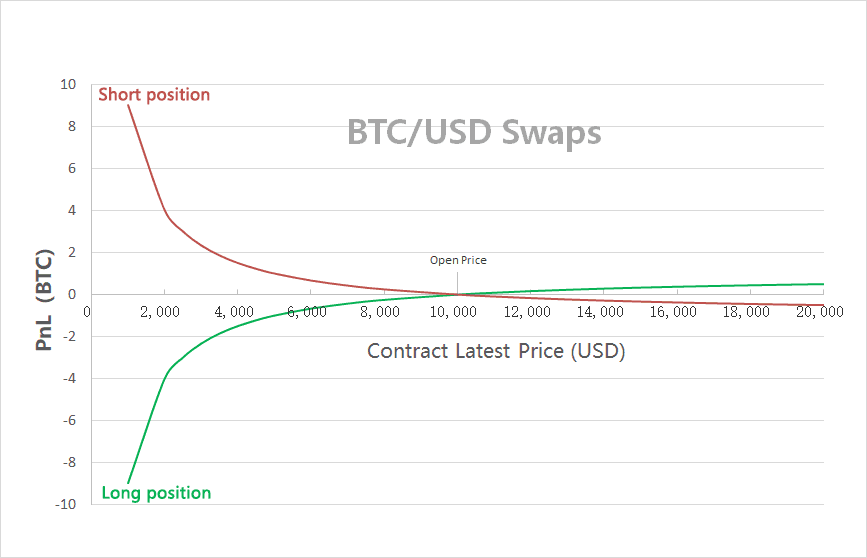

Since the margin currency of the two is different. The value risk of each margin currency will also be different in a falling market. For example, if the BTC price falls, the margin (BTC) required for positions of BTC/USD swaps will be more. However, for USDT-margined swaps, the margin currency is USDT, meaning the falling BTC price won’t affect the value of its margin currency USDT. - PnL calculating currency: USDT-margined swaps of all tokens use USDT to calculate PnL while coin-margined swaps use the underlying asset to calculate. For example, in BTC/USD swaps trading, BTC is used for calculating PnL.

The difference in PnL calculating currency leads to different PnL models. Assume we open 100 conts of BTC/USDT swaps and BTC/USD swaps at the same price, the PnL model of each will be as following: